For those of you with clients in sustainable investments, the FCA’s Sustainable Disclosure Requirements (SDR) will disrupt the landscape. All will be revealed soon, with the publication of the final guidelines expected in September. Whilst we’re hopeful SDR brings more clarity and confidence to the market, we are not kidding ourselves that it’s a panacea, as with SFDR (the European taxonomy), labels do not always paint the whole picture.

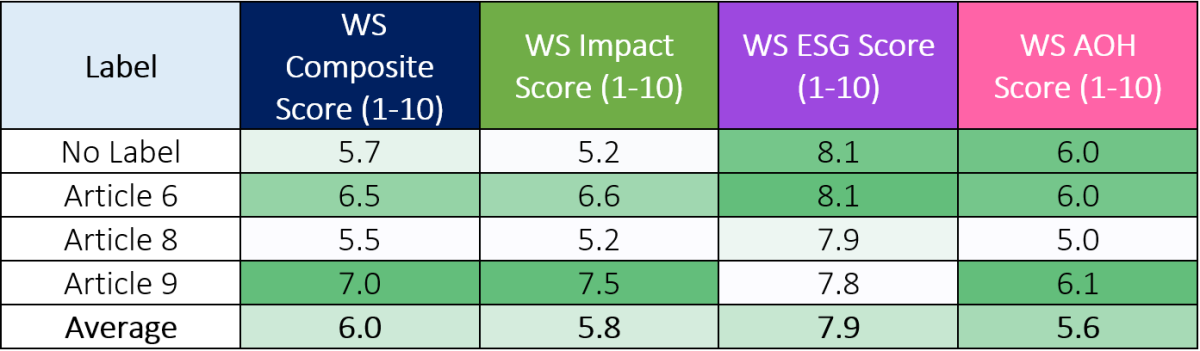

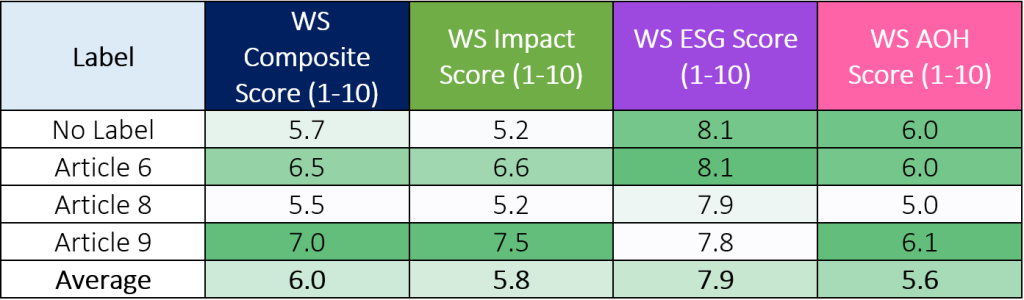

Here are three key findings from our analysis of the sustainable fund universe within their SFDR categories (starting with the good news first):

- Only Article 9 funds can be differentiated as having stand-out sustainable outcomes

- Article 8 is not a reliable indicator of the sustainable characteristics you might hope to see in a fund – when assessed on positive impact these funds score materially lower than the average fund

- We’ve made this point before but it’s so important we’ll keep making it – ESG is not a reliable differentiator when it comes to impact.

Our analysis shows that whilst Article 9 funds do indeed outperform the rest of the market across our impact criteria, Article 8 funds underperform across the spectrum. Article 8 funds should promote environmental or social characteristics , however our analysis shows that investors should have little reason to believe that these funds would be any more sustainable than Article 6 or label-less funds.

Although SDR is billed as setting a higher bar than SFDR, both labelling regimes attempt to prevent greenwashing and provide investors clarity on the real investment objectives of funds. Critics argue that the SFDR labels leave many investors confused. To date, SFDR labels have provided anything but clarity, teething problems exemplified by the recent €270bn[i] of Article 9 funds downgraded to 8.

In the UK market, by Q3 2024, funds vying for a sustainable badge must meet the criteria set out by the FCA in one of three categories and will be labelled as either Impact, Focus or Improver.If a fund doesn’t apply for one of these then there’s a long list of terms commonly used now that won’t be able to be used in the fund name going forward (e.g. Ethical, ESG, Responsible etc etc). There is talk of a potential ‘safe space’ for those funds that will fall outside the labels, but we’ll have to wait until the final guidance from the FCA to find out what that looks like. Whilst there is still much to be ironed out with each label, and with managers currently grappling with Consumer Duty, we do not expect to see much movement from asset managers until later this year – we’ll keep you posted!

Having delivered one of the most popular talks at last year’s Impact Investment Academy, regulatory guru Phil Spyropoulos is set to return again at this year’s Academy to provide another crucial update on the SDR implementation.

[i] Fund Europe, “Article 9 ETF funds downgraded”, May 2023