Is B Corp just virtue signalling or a stamp of genuinely good business? Full disclosure, we are ourselves wholeheartedly a B Corp! But we are also an evidence-led business. We scrutinise data on Asset Managers who offer Sustainable Investment funds looking for signals that identify higher quality product. So as it’s B Corp month we thought it timely to see whether B Corp certified Asset Managers are in a league of their own.

There are only six B Corp certified Asset Managers who offer Sustainability funds available to UK retail investors; First Sentier, Lombard Odier, Mirova, Montanaro, Triodos & WHEB.

Here are 4 insights you may not have been aware of:

1. It’s an inclusive community but few make the grade

Only 6 of the 100+ Asset Managers offering sustainable funds to UK retail investors are B Corps. This is understandable given the high barriers to entry. Certification rewards businesses that evidence they value purpose as much as profit whilst also meeting rigorous standards of social and environmental performance.

2. Do funds managed by B Corps outperform the rest?

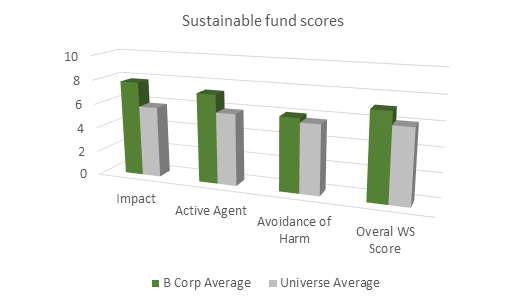

Unsurprisingly, funds managed by B Corps score significantly higher across our social and environmental metrics (more about our metrics here).

3. Leading by example

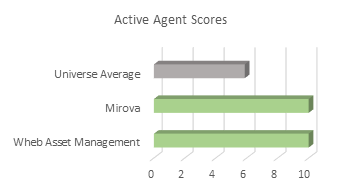

Stewardship & engagement has, thankfully, never been more prevalent. Our Active Agent score assesses Asset Managers on their stewardship efforts, practices and policies. B Corps are setting the bar high. Our two highest-scoring Asset Managers (out of 100+) are both B Corps – Mirova & WHEB.

4. Courage and conviction

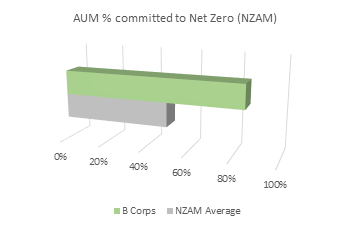

Whilst some of the world’s giant asset managers are running scared of high-profile climate initiatives. We recently published our annual report which looks at the ratings of a universe of over 100 Asset Managers related to 28 sustainable investment initiatives. It’s encouraging to see B Corps are making bold commitments with more of their assets under management to be in line with Net Zero by 2050. A massive shout out to Mirova & WHEB who are ‘all in’ with 100% committed.

So back to our original question: is B Corp just virtue signalling? Based on a statistically significant sample size of >100 Asset Managers our conclusion is that B Corps are offering funds that score better than average across the board on our sustainability metrics and ratings.