SDRs not just for Christmas…

But what changes might impact an Adviser’s business, and when can you expect to see changes affect you and your clients?

The release of SDR was some Christmas present for the sustainable investment industry. 2024 will see the real work begin, however. We would encourage Advisers to take note now and focus on understanding and complying with the new regime, here are three key reasons why.

- The Anti-greenwashing rule will come into effect on the 31st May and applies to all FCA authorised firms – including Advisers!

It requires that any reference to sustainability is “clear, fair and not misleading”. This applies to all communications and claims, so Advisers should be reviewing all of their sustainability references to ensure they are accurate and can be backed up under scrutiny. Even using ‘green’ imagery might be a form of inadvertent greenwashing. The FCA is due to publish guidance designed to help Advisers understand the new expectations in “early 2024”. Advisers should be proactive and be conscious of the reputational risk of landing on the regulatory radar by offering products and services that do not live up to what they are claiming.

How can we help you? Advisers can minimise the greenwashing risk in the portfolio construction process using the Worthstone Impact Portal.

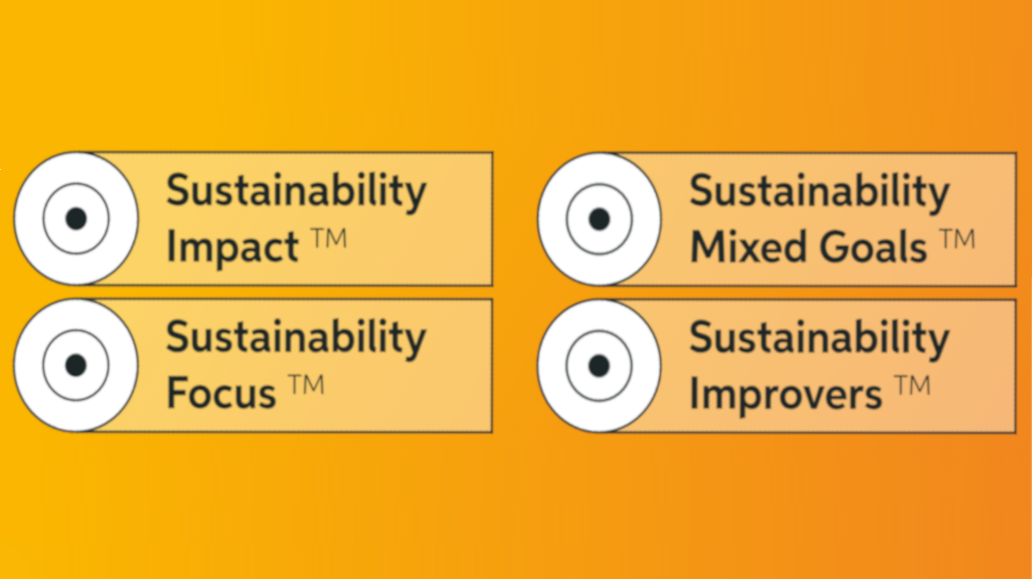

- Advisers should be aware that despite the FCAs flagship Naming & Marketing rules not officially coming into force until December, The FCA has allowed for the early adoption of the SDR labels (Focus, Improvers, Impact & Mixed Goals).

Advisers should expect to start seeing the new fund labels from July. We know many Asset Managers are targeting early adoption and recent research suggests we could see as much as 300 labelled funds by the end of 2024. Expect to see most of those funds in the Focus & Mixed Goals categories with a small minority of Impact & Improver funds. Advisers should be aware of the unique objective behind each label.

- When the rules do come into force in December, Advisers should be aware that certain terms used in the naming and marketing of funds will come with strings attached:

- Only SDR Labelled funds can use the terms ‘Sustainable’ or ‘Sustainability’ in their names.

- Only Impact Labelled funds can use the term ‘Impact’ in their names.

- Unlabelled funds can use some conditional words like ‘ESG’, ‘Responsible’ or ‘Green’, if they are material to the product. But firms must make additional disclosures justifying the term and explain why they are not applying one of the four SDR Labels.

We assess the entire universe of sustainable funds available to UK retail investors and we expect a flurry of name changes to comply with the new rules. Advisers should be on the front foot when it comes to a situation where a client questions why their money might no longer be invested in a ‘sustainable’ labelled fund.