April sees the 1-year anniversary of the Wellth Impact Investment Portfolios. The goal of the portfolios is to maximise positive impact as well as delivering long-term financial returns.

As sustainable impact investing specialists, Worthstone’s analysis identifies the best sustainable funds from an impact perspective for inclusion in the portfolios.

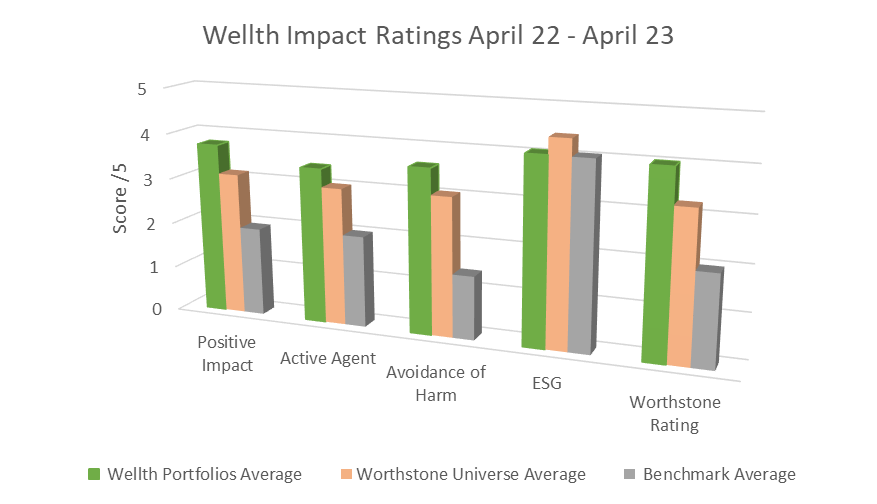

The Worthstone universe comprises the entire spectrum of sustainable funds available to UK retail investors. For each fund, the impact of the fund’s investments is calculated by using the underlying companies’ revenue streams. The impact of the asset manager is also assessed by evaluating their investment practices, policies & stewardship. The building blocks shown below are combined to generate a Worthstone composite rating. By scrutinising and applying our unique and rigorous methodology across the entire universe we aim to identify those best-in-class sustainable funds to build portfolios that are making a real difference.

The relative impact ratings of the Wellth portfolios over the first year have been extremely encouraging. The portfolios have significantly higher impact ratings than the sustainable fund average and the benchmarks.

We are not concerned that the Wellth ESG scores are marginally lower than the sustainable fund average because we know that ESG scores offer limited insights in isolation when assessing the real social or environmental impact of a funds underlying companies, as we evidenced in our recent blog.

We are particularly pleased, but not surprised, that the Active Agent rating is higher than both the universe and the benchmark. Seeking out managers that engage actively to make real world change is central to our methodology.

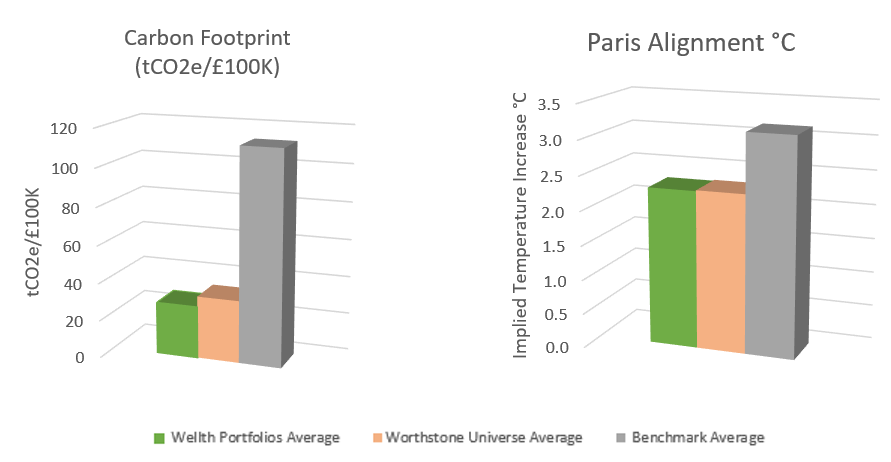

The Wellth portfolios seek to minimise their carbon footprint. The chart shows how the Wellth Portfolios’ outperform the sustainable fund average and have a significantly lower footprint than the non-sustainable benchmarks.

The Paris Alignment metric, referring to the global commitment to avoid dangerous climate change by limiting global warming to well below 2°C, shows the Wellth Portfolios nearing the target, and significantly beating the worrying benchmark. This is one of the most challenging targets for a globally diversified portfolio to achieve. The release of the IPCC’s sobering report in March highlights the scale of the challenge faced, with diminishing potential of limiting warming to 1.5°C. Our Paris Alignment metric shows that huge improvements are required even for the most sustainable companies. Recent data has suggested that only 11% of sustainable funds worldwide are currently projected to be below the 2°C target[i].

So that’s the positive impact but how are the Wellth portfolios matching up to meeting sound financial planning principles from a financial return perspective?

Here are some comments from Richard Brill, the Wellth portfolio manager:

“It’s fair to say Wellth’s portfolios first twelve months have been exposed to challenging market conditions. 2022 was one of the most challenging years for investors in recent history, the first year on record where both bonds and equities fell by over 10% leaving nowhere to hide. It was particularly difficult for sustainable assets, which tend to be longer duration growth assets. This type of asset gets hit harder when we see central banks quickly raise rates. On top of this, the purposeful exclusion of oil and gas, one of the only industries to capitalise on the prevailing conditions in 2022, carries a consequence that the portfolios have underperformed (on a financial performance basis) relative to the traditional (unconstrained) market benchmarks.

However, there were positive signals that the long term tail winds for sustainable assets remain strong and some, like the need to develop alternative energy in Europe, have actually accelerated. This has been a difficult year for sustainable assets, there is no getting round this. However, clients should be long term investors and one year, specifically this year’s performance, should not deter their long-term aspirations and views.”

One year in we are pleased that interest in the Wellth portfolios has been strong. A growing number of top tier financial advisers are utilising this proposition as their outsourced solution for those clients seeking to invest in a best-in-class positive impact portfolio. The robust process, granular impact analysis and transparent reporting builds trust with interested clients. If you would be interested to find out more, please contact us here.

[i] S&P Global “Green funds have a Paris alignment problem” June 7, 2022