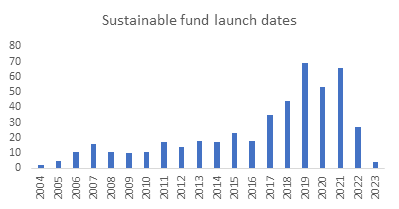

Our research shows that the number of new sustainable fund launches has fallen off a cliff since the announcement of the FCAs Sustainability Disclosure Requirements (SDR).

Worthstone analyses the entire sustainable fund market available to UK investors. Since 2004 (the birth of the term ‘ESG’) there have been steady increases in the number of new sustainable funds available each year. The real boom, however, started in 2017 as asset managers rushed to capture the skyrocketing consumer demand for sustainable products. Fears over greenwashing have grown in equal measure, and the FCA announced in late 2021, its intention to regulate the market. Since the announcement and subsequent consultation paper, we have seen a sudden and stark drop off in new funds. Sustainable fund growth is at its lowest level in 20 years.

With the final SDR guidelines delayed, we suspect a combination of uncertainty over the incoming regulation, alongside recent market headwinds for sustainable assets have been a major deterrent for new sustainable products.

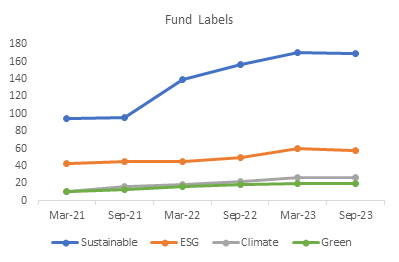

Similarly, our analysis shows that growth in the number of funds using sustainable-related labels has declined for the first time too. Is this just a short term blip or could this be the start of a major distilling of the sustainable market, as asset managers tentatively remarket funds in anticipation of the FCAs anti-greenwashing rules?

A common thread across the 240 written responses to the SDR consultation, was fear the requirements overcomplicate and narrow the definition of a sustainable product, ultimately resulting in fewer funds available. The FCA’s intention is to curb greenwashing but our analysis shows they may already be stunting the market and curbing consumer choice.