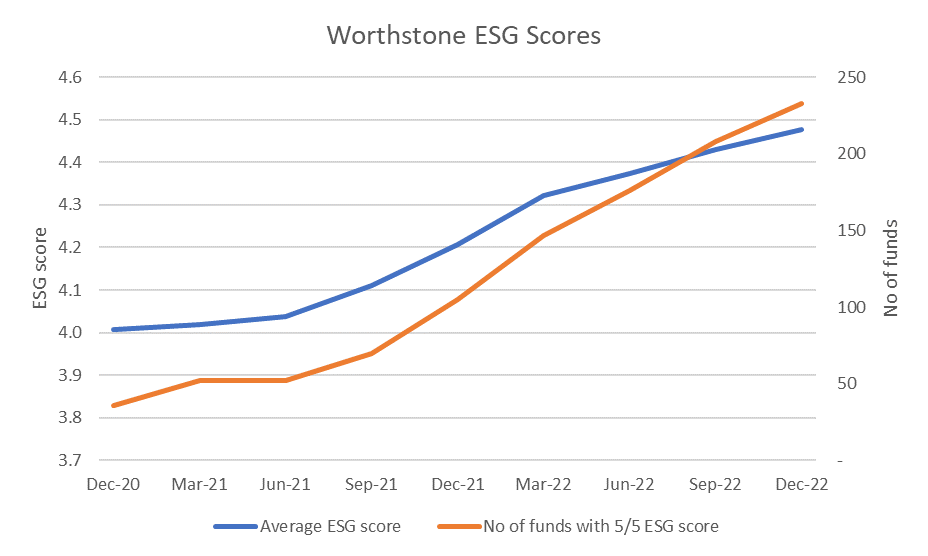

ESG ratings inflation is making global inflation look moderate. The number of funds in our universe that score the maximum 5/5 has risen from just 10% two years ago (at the height of explosive growth in the number of sustainable funds) to over 55% today. We’ve observed ESG score inflation consistently each quarter since then, to the extent that our average ESG score for a fund now stands at 4.5 (out of 5). So what’s the problem?

This matters because, if Deloitte’s research is accurate, 2/3rds of investors use ESG assessments every week[1]. As one of the most common yardsticks used by investors to rank sustainable funds, with this level of inflation, ESG ratings may no longer add value as a tool to help differentiate the sustainable funds market.

ESG ratings assess the Environmental, Social and Governance practices (how a company operates) of a portfolio’s holdings. They aim to measure the financial risks and opportunities associated with each factor. A company’s approach to each E, S & G factor will affect its long-term risk-and-return profile. Ratings, therefore, provide investors insight into those risks and the relative resilience of a portfolio to large scale issues such as climate change or demographic shifts.

Another way of looking at ESG ratings is as a gauge of the risk the world poses to a company and not the other way around. They do not measure the benefit to people or planet of the underlying company’s product or service (what they produce). This important distinction has caused much confusion among investors. It explains why Exxon can have a higher ESG rating than Tesla, or why top ESG rated funds can still perform poorly in terms of generating a positive impact or avoiding harm.

So we at Worthstone feel that while ESG ratings are useful as a proxy to illustrate the relative financial resilience of a fund’s holdings, it is of limited use when assessing if those holdings are in companies which may provide solutions to a sustainable world.

That’s why ESG is only one element of Worthstone’s methodology, carrying the lowest weighting within our overall rating of each fund.

This may not have gone unnoticed by the FCA and with the introduction of Sustainability Disclosure Requirements (SDR) and investment labelling regime, there has been a renewed emphasis on correctly distinguishing between mere ESG factors and the true sustainable characteristics of funds. For the last five years, Worthstone has been assessing ESG factors alongside other elements such as a fund’s revenue contribution towards the UN SDGs. In our view, ESG ratings are only useful as part of a much larger toolbox when ranking funds based on how much they benefit society or the environment.

Hyper-inflation in ESG ratings might signal that firms are increasingly recognising and better managing the risks and opportunities associated with ESG factors. The cynic might counter that the bigger global players are getting better at gaming the rating systems. Not surprising given the rewards on offer. In achieving higher ESG ratings, companies can benefit from improved shareholder relationships and increased access to lower-cost capital.

We’d love to hear what you think…..

[1] “ESG Ratings: do they add Value?”, Deloitte 2023