The FCA has just announced that the final Sustainability Disclosure Requirements (SDR) will be published by the end of the year instead of Q3. The anti-greenwashing rule is still expected to come into force immediately upon publication of the final policy statement. Adviser debate on the ambiguity of sustainable investment labels and the potential to mislead investors continues to rumble on. This was undoubtedly in the regulator’s mind when drafting the proposed anti-greenwashing rule. With the recent boom of funds marketing themselves as sustainable, how much of a shake-up will we see when the rule eventually comes into force later this year?

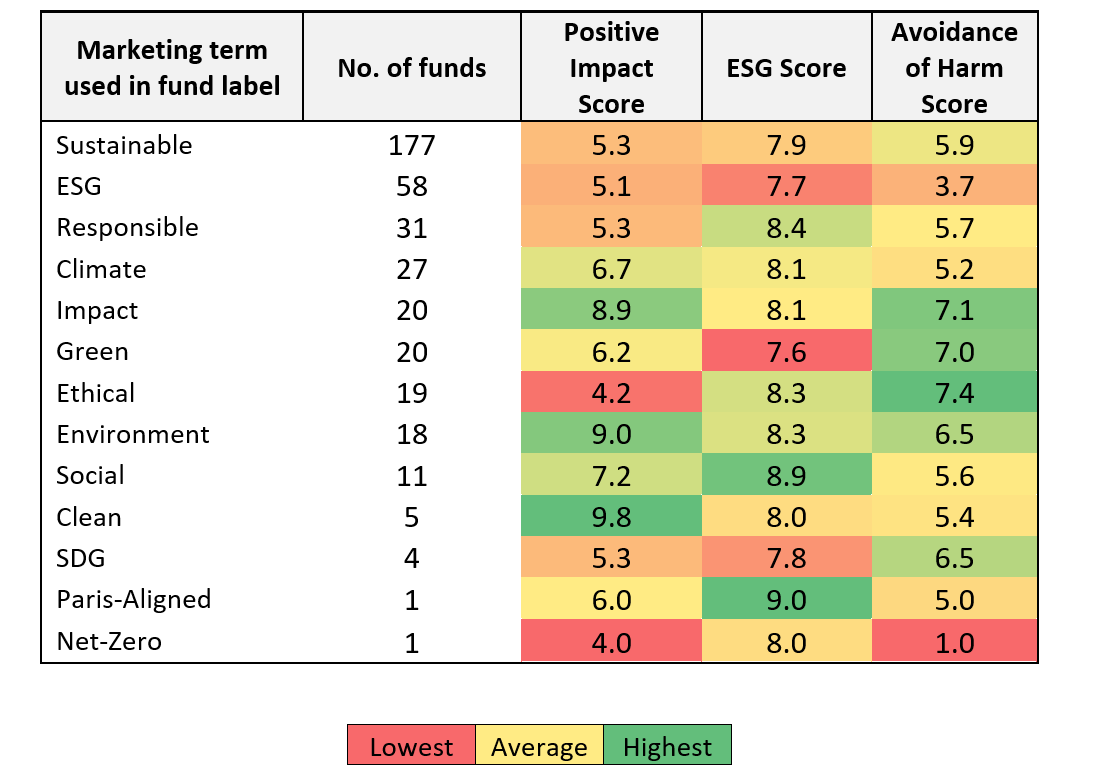

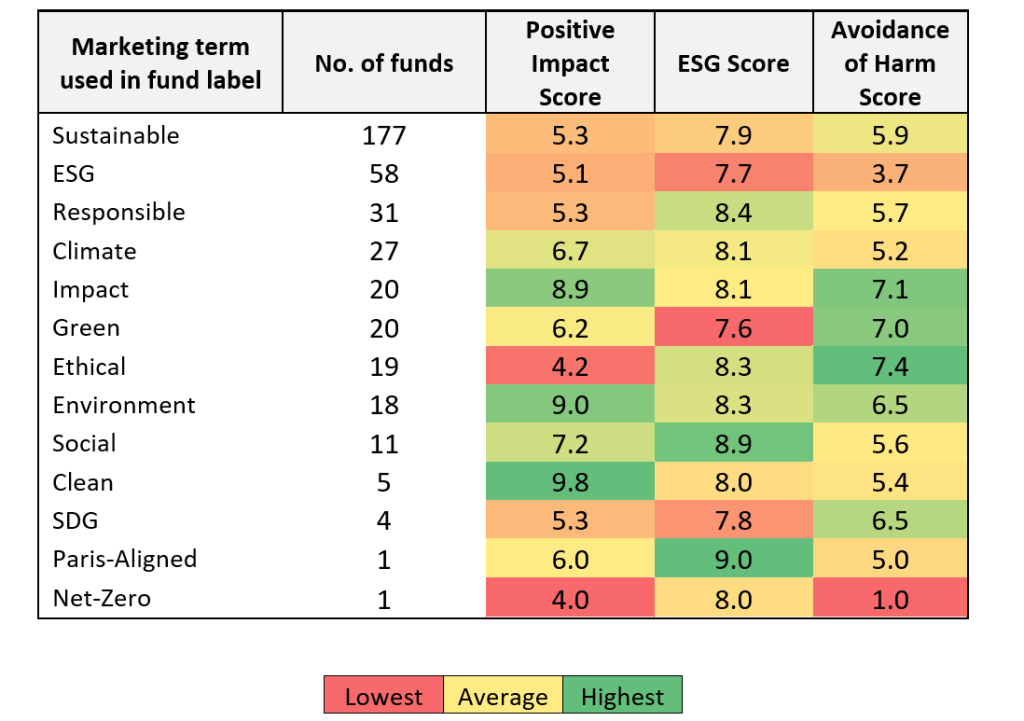

The rule states that the naming and marketing of a fund must be clear, fair, and not misleading. Based on our assessment this will give the regulator lots to go at if many of the funds currently available apply for a label under SDR. We’ve been looking beneath the label of funds for years and often ended up scratching our heads as to how a sustainable nametag could be justified in many cases. Until now, there have been low barriers to entry for those asset managers looking to exploit the burgeoning consumer demand for sustainable products by just tagging or repurposing funds with green-ish terms. Looking across >500 sustainable funds in the Worthstone universe (i.e. verified as available to UK retail investors and including a prescriptive sustainable objective) we’ve listed here the most popular tags and their scores across three of our key assessments:

The anti-greenwashing rule states that the labelling and marketing of a fund must be consistent with its sustainability profile. Based on our analysis, many funds will have to drop their current labels and remarket themselves without these tags. With our consistent methodology applied across the entire fund universe, it brings greater clarity to the sustainability focus behind each term. How accurately do current fund labels reflect their underlying sustainable characteristics? Here are a few insights from our analysis;

- ‘ESG’ labelled funds perform poorly across the board – they even have some of the lowest ESG scores! ESG tags are rarely good indicators of sustainable outcomes and may be found to be misleading for investors.

- ‘Impact’ labelled funds perform well across all metrics. Along with ‘Environment’ & ‘Clean’ labels, they look consistent with the most sustainable outcomes.

- ‘Ethical’ labelled funds have some of the highest avoidance of harm scores, but conversely some of the lowest impact scores. Unsurprisingly this suggests ‘Ethical’ labels are consistent with an ‘exclusionary’ approach to investing, avoiding unethical goods and services, rather than pursuing specific positive outcomes.

So far the FCA has taken a hardline approach; funds that do not qualify for the sustainable labels cannot use terms such as ‘ESG’, ‘climate’, ‘impact’, ‘sustainable’, ‘responsible’, ‘green’, ‘SDG’, ‘Paris aligned’ or ‘net zero’ in their product names and marketing. Even the officially labelled Sustainable ‘Focus’ & ‘Improver’ funds might be prohibited from using the term ‘impact’.

But how big a shift will we see for funds using sustainable nametags? The next key question here is will this need explaining to investors in these funds and how will they react? We still await the final guidelines, with the rumoured ‘safe-space’ for funds that may not qualify for a label (but still have some sustainability-related characteristics). The day of reckoning awaits!