When a client says they want to do good with their money, how do you make sure it happens?

With the profile of sustainable investment growing significantly in recent years – a trend that only accelerated during the pandemic – clients are increasingly looking for ways to make their money do good. But how do you know what good really looks like?

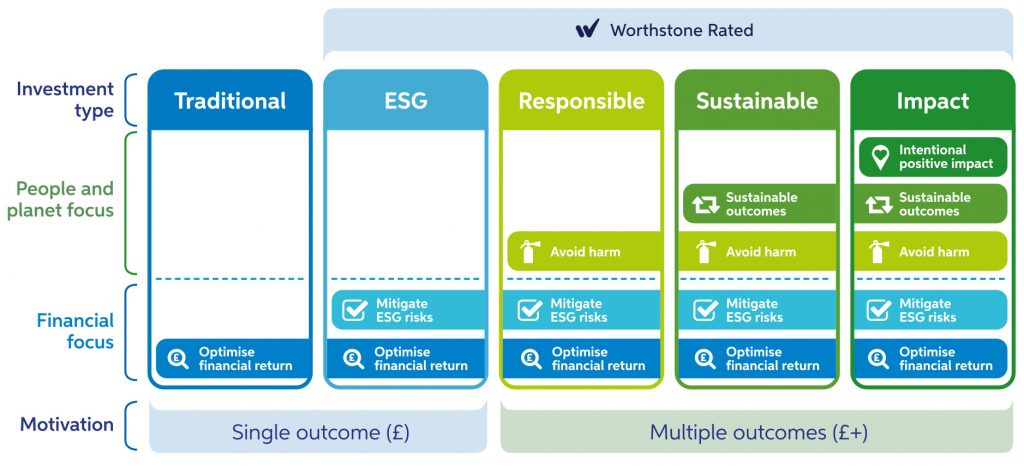

Terms like sustainable, ethical and ESG are used interchangeably, and with new funds launching and rebranding, the market is a minefield and it’s difficult for advisers to know what’s beneath the label of each fund, and how they compare.

Pitching ESG and impact investing against each other is an eye-catching but unhelpful way of looking at things. Apples and oranges come to mind.

The key is going back to your client’s objectives and being completely transparent about where their money is going. For some clients ESG investing might be the right route to meet their goals and align with their values. However, if the client’s goal is financial returns along with positive social and environmental impact, ESG screening isn’t going to answer all their questions.

ESG screening is just one lens through which to view a fund and as such will only ever give you part of the picture. Impact investing optimises for a set of desired outcomes, rather than just maximising one. It goes well beyond ESG screening and seeks to proactively invest in companies which can make a positive difference.

The difference between ESG investing and impact investing is best illuminated when you look at real examples. According to our latest analysis the top rated ESG fund scores poorly when you take a more rounded view of its overall impact. It includes investment in arms and tobacco.

In this case, a client expecting their money to be doing good might be surprised to see what they’re funding. Being careful and precise with language (ESG, responsible, sustainable, and impact) is vital to avoid the risk of greenwash.

Since 2011 Worthstone, a certified B Corporation, we’ve been helping financial advisers look beneath the label of a fund, see the full picture and make informed decisions.

Our online Impact Portal allows financial advisers to quickly and easily rate the impact of a fund based on five key measures. The data is codified and visual making it digestible and engaging for clients so advisers can share the holistic performance of a fund and portfolio.

Data should only be used as a proxy when assessing a fund’s impact, what advisers and clients really need is insight. We review and update our ratings every quarter, analysing the retail investment funds which have a sustainable mandate against five key metrics using 250 data points to collate the definitive list of funds qualifying as impact investments – currently around 400 funds.

An additional data point which investors are becoming sensitive to is the alignment of funds to the goals of the Paris Agreement to cut greenhouse gas emissions and limit global temperature rise to 1.5°C above pre-industrial levels. We analyse funds on this basis and will be releasing data on what we have found in the coming weeks.

With the FCA’s recent Sustainability Disclosure Requirements (SDR) and investment labels Discussion Paper currently being consulted on and strong signals that they expect financial advisers to be incorporating sustainability into all conversations with clients, now is the time to pre-empt further regulation. Always look under the label of funds to make sure you know whether the investment is aligned to your client’s objective.

Gavin Francis

Founder and Director